KOA RIDGE LENDERS

We've partnered with Hawai'i's top lenders to provide you with the lowest rates and the most comprehensive mortgage financing services.

For 2024, Fannie Mae expects lower mortgage rates will boost new home sales and shore up home prices in the near-term. This may be a good time to think about a brand-new home.

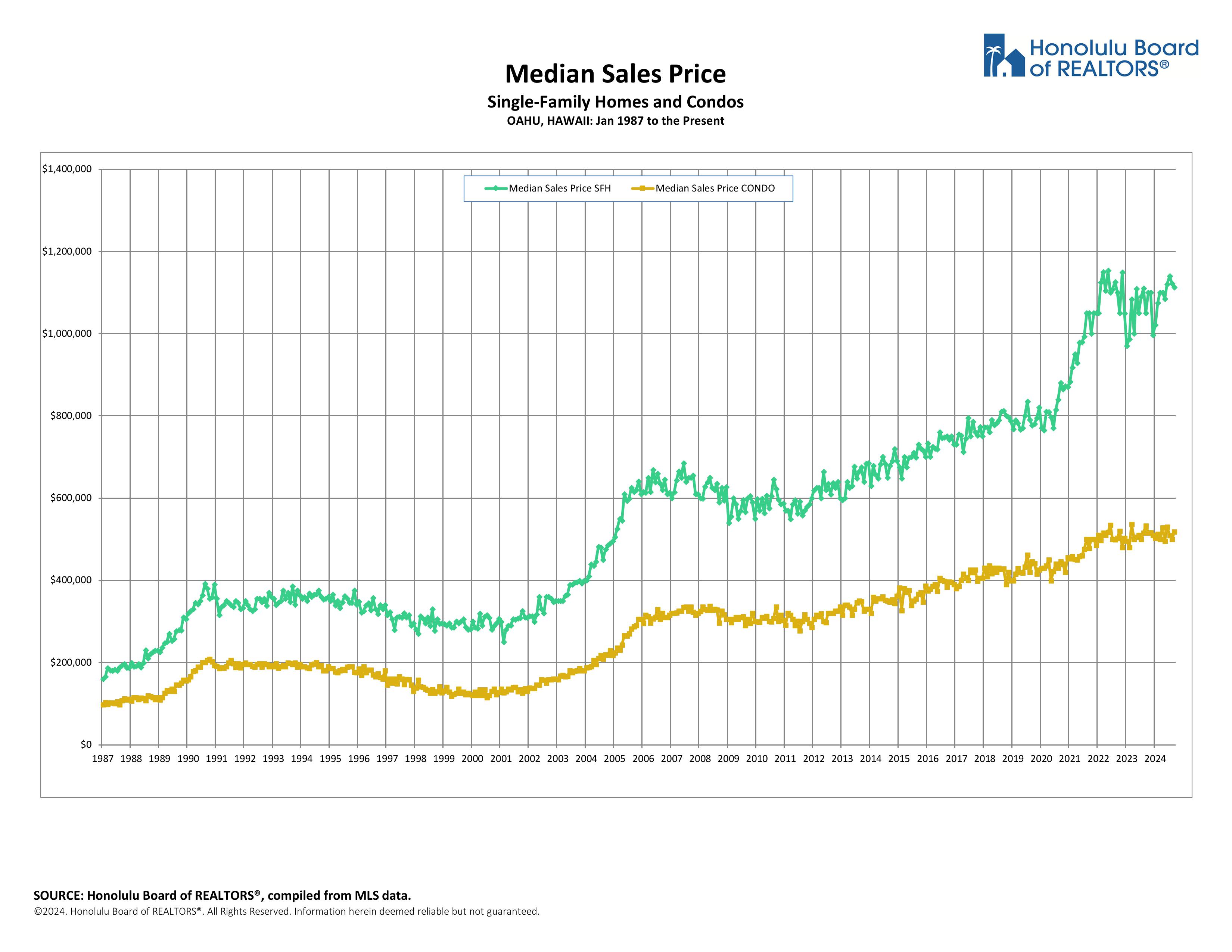

Home Prices are Likely to Keep Rising

If you have the means, itâs a good time to consider taking advantage of Special Financing options and the right time to do so is up to you. Our designated project lenders are here to help.

Supply. Far fewer new homes have been built since 2008, and the homes in the (existing) resale market are often in need of big repairs and renovation and often were built to a different standard which means less homes to choose from.

Interest Rates. The impact of the Fedâs lowering the funds rate action was largely already priced in and rates may not come down as quickly as previously expected.

⢠On the heels of the Fedâs action, mortgage rates arenât falling. When rates do drop, demand will likely increase leading to less inventory and more competition for buyers.

⢠Home prices continue to go up with limited inventory and crushing increases to new construction costs.

Specials. Check out Koa Ridge for SPECIAL FINANCING and other opportunities on select homes when these programs are available, as these are limited in nature. Mortgage loan officers can show many homebuyers that you may have more possibilities than you think.

For homebuyers that want to buy now here are few things to consider. We recommend you analyze the nuances of the neighborhood as where you live does determine how you live.

Here are three (3) instances in which it might make sense for you to consider buying NEW:

Takeaway No. 1: A newly built home is NOT subject to the high insurance premiums and remodeling that is impacting and sidelining older existing structures. In addition, new construction is built based on climate change lessons for hurricane and wind resistance.

If you are financially able to purchase now, please remember, your home is your home, not an investment. At some point in the future, you may need to access the equity for your personal circumstances. If you have a long-term time horizon â history has shown that you donât have to be perfect to experience good results.

Takeaway No. 2: Inventory is extremely limited. New Home Inventory is an opportunity.

It is important to determine where it is you want to call home. In the (existing) resale home market, competition for homes is still occurring in certain neighborhoods and there are buyers that have been outbid. If that is the case, consider a new home, in a great neighborhood, where everyone has equal footing â either first-come, first-serve or a lottery. Another benefit of new construction is that much of what is available in the resale market is in need of a remodel or updated maintenance which can add up to be quite costly.

Takeaway No. 3: Mortgage rates of the past 50 years

Today interest rates mirror the mortgage rates of the early 1970s. Donât expect rates to fall anytime soon. As rates improve, the housing forecasts envision a sales bump next year. With more affordability there will likely be an increase in demand and as supply remains limited typically it means less homes to choose from and probably at higher sales prices. If you are considering purchasing at todayâs mortgage rates, please discuss with your lender what the possibilities are for a refinance in the future.

See our experienced loan officer teams for assistance and let us know how we can be of service.

Whichever home type you are looking to buy at Koa Ridge, First Hawaiian Bank offers a complete range of mortgages and home loans to fit your needs. Weâre committed to providing outstanding service every step of the way.

Make your dreams a reality with affordable Mortgage Loan Options from Central Pacific Bank. We find the right loan product to meet your mortgage financing needs, with no to low down payments, and promotions for new home purchases.

We can help you realize your dream of homeownership with a wide array of home loans and mortgage programs to meet your needs.

If youâre in need of a lender for your new home purchase, youâve come to the right place. SimpliFi Mortgage by Bank of Hawaii can help you get the right mortgage fast and easy, and with experts that understand the market, youâll be at an advantage.

Keiki Koa - Symbol of New Life

Like a sprouting Koa tree, the Hale Lau Koa (house of Koa leaves) community at Koa Ridge provides a new and unique âokipuâu forest clearing as a place for families to plant their roots, cultivate the community, and grow in life

Learn More >